By: Parmis Mokhtari-Dizaji

Edited by: Alejandro J. Ramos

Introduction

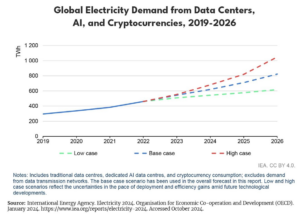

As we embrace a new digital era marked by the massive growth of artificial intelligence, machine learning, and neural networks, the demand for data centers, which are tasked with supporting these complex computations, is expected to rise substantially.

Data centers are the backbone of the digital era, providing the infrastructure needed to produce, store, process, and transmit vast amounts of data. Data centers are increasingly central to digital growth. By 2030, the global data center market is expected to exceed $500 billion.1 Significant investment in server production and energy infrastructure will be necessary to meet this substantial market demand.

With the rapid increase in energy demand and reliance on electricity generated from fossil-based power plants, a rise in carbon emissions is inevitable unless alternative clean energy sources are adopted.2 The global data center industry is projected to emit 2.5 billion tons of CO2 by 2030, equivalent to about forty percent of the annual greenhouse gas emissions of the entire United States.3 In response, governments worldwide are introducing regulations and legislation mandating businesses to reduce their carbon footprints, particularly in regions with the highest levels of pollution.4

On the other hand, the growth in energy demand comes with financial challenges, particularly in operating costs. Electricity consumption, driven by energy-intensive processes such as artificial intelligence computations and rising energy prices, remains the largest ongoing expense for data centers, comprising forty percent to sixty percent of their total expenditures.5

With the United States hosting nearly one-third of the world’s data centers, it holds a critical responsibility in shaping the future of this industry.6 Green Power Purchase Agreements offer a viable pathway to address these challenges, allowing data centers to secure renewable energy directly from producers, stabilize electricity costs, and significantly reduce carbon emissions. As global energy demand for data centers is expected to double within the next two years, leveraging green Power Purchase Agreements will be key to building a sustainable and resilient digital infrastructure for the future. 7

How Green PPAs Address Energy Demands

Power Purchase Agreements (PPAs) offer a practical solution to the rising energy demands by enabling data centers to source energy from renewable energy suppliers or facilities. Buyers commit to purchasing renewable electricity through long-term PPAs, typically lasting over ten years.8 These agreements outline critical terms such as the price of electricity, delivery schedules, financial conditions, maintenance responsibilities, and performance guarantees, ensuring the buyer receives a consistent and reliable supply of renewable energy.9

Additionally, green PPAs contribute to stabilizing local electricity grids by reducing peak demand on conventional power plants and encouraging investments in local clean energy infrastructure, such as solar panels, wind turbines, and other renewable technologies.10 In 2023 alone, corporate renewable PPAs accounted for forty-six gigawatts of solar and wind contracts, representing a twelve percent increase over the previous record of forty-one gigawatts in 2022.11

Green PPAs in Practice: Case Studies of Tech Giants

Green PPAs have garnered substantial support from tech giants such as Amazon, Microsoft, Google, and Meta, enabling these companies to meet the immense energy demands of their data centers and sustain their AI-powered growth.

Amazon, under its Climate Pledge, stands as the world’s largest tech purchaser of renewable energy, with investments in over 500 projects across twenty-five countries.12 Microsoft aims to achieve carbon-negative status by 2030, utilizing green PPAs to power its data centers while advancing energy storage technologies and grid decarbonization. Similarly, Google is pursuing its 24/7 carbon-free energy goal for data centers, and Meta depends on green PPAs to fuel its AI and metaverse initiatives.13

These companies have not only embraced renewable energy but have also invested billions of dollars in driving innovation and expanding renewable energy infrastructure. This strategy has allowed them to exert significant influence over the location and development of green energy facilities, ensuring proximity to their data centers and strategically investing in solar and wind farms near their operations.14

While this demonstrates the transformative potential of green PPAs for large-scale energy consumers, it also raises a critical question: can green PPAs become a viable solution for small and medium-sized data centers as well?

Expanding Green PPAs to Small and Medium-Sized Centers

Over fifty percent of U.S. data centers are small to medium-sized, primarily serving metropolitan communities—major emission sources.15 Adopting local renewable energy sources could allow these centers to significantly reduce urban emissions, often having a greater localized impact than larger data centers situated in remote areas.16

Green PPAs can provide a practical way for these smaller data centers to access renewable energy at stable, competitive rates. For instance, a fifteen-year green PPA utilizing solar energy could enable a small data center to lock in consistent electricity prices while significantly cutting emissions. Legislative support, such as carbon taxes and renewable energy tax credits, could further encourage small and medium-sized businesses to adopt green PPAs, allowing them to collectively negotiate agreements at scales like those of major tech companies.

Consider the partnership between Cyxtera Technologies, a provider of hybrid IT infrastructure and data center services, and NextEra Energy, one of North America’s largest renewable energy developers. In 2020, Cyxtera partnered with NextEra to source clean energy for its data centers and to develop next-generation facilities with sustainable technology.17 As part of this collaboration, NextEra supports Cyxtera by installing distributed renewable energy systems across its North American data center footprint, which has a power capacity of more than 200 megawatts, accelerating Cyxtera’s progress toward carbon neutrality.18 By leveraging NextEra’s expertise as a leading generator of wind and solar energy, Cyxtera has reduced its environmental impact and achieved its sustainability goals more efficiently. This partnership demonstrates how mid-sized data center providers can overcome financial and logistical challenges in securing green energy by collaborating with established leaders in the renewable energy sector.

However, a significant barrier to adoption remains the long-term nature of many PPAs, which can be less appealing in an industry prone to economic, technological, and regulatory shifts. A key risk of long-term contracts in a volatile energy market, particularly with renewables like wind and solar, is that advancements in technology or market shifts could lower energy prices, leaving buyers locked into contracts with fixed rates that exceed market prices, resulting in financial losses.19 Additionally, regulatory changes, such as the upcoming replacement of the U.S. Production Tax Credit for wind energy in 2025, could add further uncertainty to long-term agreements.20 Shorter contracts, such as five- to seven-year agreements, could mitigate these risks while aligning with the expected thirty percent growth in the global PPA market over the next decade.21 Offering flexible contract terms and adjustable pricing could make these agreements more accessible without compromising the financial viability of suppliers.

Incorporating Renewable Energy Certificates (RECs) into these agreements could further enhance sustainability efforts.22 RECs verify that energy is generated from renewable sources, allowing data centers to offset carbon emissions or earn carbon credits. This approach provides an additional incentive for adopting green PPAs and supports broader sustainability objectives.

To ensure reliability, even during periods of low solar or wind energy generation, green PPAs can incorporate strategies to address these challenges. One effective solution is “24/7 matching,” which ensures renewable energy sources align with a data center’s energy needs on an hourly basis every day of the week. This is achieved by combining diverse renewable energy sources, such as wind and solar, with battery storage to save excess energy for later use, supplemented by additional energy purchased from the grid when necessary.23 Although implementing this method may involve higher upfront costs, government support could encourage adoption by ensuring a consistent clean energy supply and reducing reliance on non-renewable power sources.

By adopting these measures, small and medium-sized data centers could access renewable energy solutions that are both practical and impactful. This would enable them to contribute meaningfully to emissions reduction and support the broader transition to a cleaner and more sustainable energy future.

Conclusion

All these efforts collectively highlight the critical role of green PPAs in fostering sustainable data center resilience. They facilitate the shift to renewable energy, help reduce carbon emissions, stabilize energy costs, and improve reliability in the face of grid instability and evolving regulatory demands. These agreements are not just tools for environmental impact—they also offer a strategic pathway for data centers to manage their energy use more effectively. Small and medium-sized data centers, often overlooked, stand to benefit significantly by becoming more efficient and resilient, while larger players continue to lead in advancing innovation and infrastructure development.

That said, challenges persist. Limited financial resources, difficulty in negotiating favorable terms, and the risks tied to long-term contracts in a volatile energy market present real barriers. While long-term agreements provide stability, they can lock buyers into fixed rates that may become uncompetitive as renewable energy prices decline due to technological advancements. For smaller players, these risks are even more pronounced, making it crucial to explore solutions such as shorter contracts, flexible agreements, targeted support, and reliable renewable energy availability to level the playing field.

As the digital era continues to grow at an unprecedented pace, addressing these challenges and refining green PPAs will be essential to ensuring data centers meet rising energy demands responsibly. By balancing growth with sustainability, green PPAs can help shape a digital infrastructure that is not only robust but also aligned with long-term environmental and economic goals.

Works Cited

1. Allied Market Research. 2021. Data Center Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component, Type, Enterprise Size and End User: Global Opportunity Analysis and Industry Forecast, 2021-2030. August. https://www.alliedmarketresearch.com/data-center-market-A13117

2. International Data Corporation (IDC). 2024. IDC Report Reveals AI-Driven Growth in Datacenter Energy Consumption, Predicts Surge in Datacenter Facility Spending Amid Rising Electricity Costs. September 24. https://www.un.org/en/climatechange/raising-ambition/renewable-energy

3. Gooding, Matthew. 2024. Global Data Center Electricity Use to Double by 2026 – IEA Report. January 26. https://www.reuters.com/markets/carbon/global-data-center-industry-emit-25-billion-tons-co2-through-2030-morgan-stanley-2024-09-03/

4. Gooding, Matthew. 2024. Global Data Center Electricity Use to Double by 2026 – IEA Report: AI and Cryptocurrency Workloads Are Driving Up Demand. January 26. https://www.epa.gov/clean-air-act-overview/progress-cleaning-air-and-improving-peoples-health

5. United Nations. n.d. Renewable Energy – Powering a Safer Future. https://www.idc.com/getdoc.jsp?containerId=prUS52611224

6. Reuters. 2024. Global Data Center Industry to Emit 2.5 Billion Tons of CO2 Through 2030, Morgan Stanley Says. September 3. https://www.datacenterdynamics.com/en/news/global-data-center-electricity-use-to-double-by-2026-report/

7. U.S. Environmental Protection Agency (EPA). 2024. Progress Cleaning the Air and Improving People’s Health. April 30. https://www.datacenterdynamics.com/en/news/global-data-center-electricity-use-to-double-by-2026-report/

8. Better Buildings Solution Center. n.d. What Is a Power Purchase Agreement? https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement

9. FG Capital Advisors. n.d. Renewable Energy Procurement and Power Purchase Agreements (PPAs). https://www.fgcapitaladvisors.com/renewable-energy-procurement-and-power-purchase-agreements-ppas

10. Better Buildings Solution Center. n.d. What Is a Power Purchase Agreement? https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement

11. BloombergNEF. 2024. Corporate Clean Power Buying Grew 12% to New Record in 2023, According to BloombergNEF. February 13. https://about.bnef.com/blog/corporate-clean-power-buying-grew-12-to-new-record-in-2023-according-to-bloombergnef/

12. Birch, Kate. 2024. Amazon Leads Corporate Charge to a Clean Energy Future. January 19. https://sustainabilitymag.com/renewable-energy/amazon-leads-corporate-charge-to-a-clean-energy-future

13. Clancy, Heather. 2024. Amazon, Google and Microsoft Signal Growing Interest in Nuclear, Geothermal Power. March 25. https://trellis.net/article/amazon-google-and-microsoft-signal-growing-interest-nuclear-geothermal-power/

14. Renewable Energy World. 2024. Navigating Key Challenges in Data Center Development: Location, Sustainability, and Hardware. May 27. https://www.renewableenergyworld.com/opinion-and-commentary/navigating-key-challenges-in-data-center-development-location-sustainability-and-hardware/

15. Better Buildings Solution Center. n.d. Small Data Centers Toolkit. U.S. Department of Energy. https://betterbuildingssolutioncenter.energy.gov/data-center-toolkit/small

16. Dgtl Infra. 2023. Cities and Regions with the Highest Concentration of Data Centers. February 1. https://irei.com/publications/article/cities-regions-highest-concentration-data-centers/

17. Energy Capital. 2021. Major Companies Like AWS Spearheaded the Data Center Growth in the US, During 2021. January. https://issuu.com/energycapital/docs/energy_capital_the_magazine-january_2022-edition_0/s/14472457

18. U.S. Securities and Exchange Commission (SEC). 2021. Cyxtera Selects NextEra Energy Resources as Preferred Supplier of Green Energy to Help Accelerate Sustainability Initiatives. July 8. https://www.sec.gov/Archives/edgar/data/1794905/000110465921090025/tm2121562d1_ex99-1.htm

19. Neuhoff, Karsten, Nils May, and Jörn C. Richstein. 2022. Financing Renewables in the Age of Falling Technology Costs. Energy Policy, August 22. https://www.sciencedirect.com/science/article/pii/S0928765522000471

20. The U.S. Department of Energy WINDExchange. n.d. Production Tax Credit and Investment Tax Credit for Wind Energy. https://windexchange.energy.gov/projects/tax-credits

21. Market.us. 2024. Global Power Purchase Agreement Market by Type. October. https://market.us/report/power-purchase-agreement-market/

22. U.S. Environmental Protection Agency (EPA). n.d. Renewable Energy Certificates (RECs). https://www.epa.gov/green-power-markets/renewable-energy-certificates-recs

23. NewClimate Institute. 2024. Briefing: 24/7 Renewable Electricity Matching Is a Far More Credible Approach for the GHG Protocol and the SBTi than the Emissions First Partnership Proposal. October. https://newclimate.org/news/briefing-247-renewable-electricity-matching-is-a-far-more-credible-approach-for-the-ghg