Written by Yeareen Yun, Brettany Tucker, Yamatha Saint Germain, Enkhzul Altangerel and Stephanie T. Coker

Edited by Eghosa Asemota

Abstract

This case profiles Ikirezi Natural Products, the only essential oils company in Rwanda which is considering expanding into the domestic market following several years of slow growth internationally. As a community-interest agribusiness, Ikirezi was founded by Dr. Nicholas Hitimana with the aim “to maximize profits to smallholder farmers, holistically transform communities, and strengthen agribusiness in Rwanda.”[1] Given its limited resources in a country lacking familiarity with the benefits of essential oils, Ikirezi faced the challenge of developing a market strategy beginning in 2017. This case study presents a comprehensive overview of the challenges, opportunities, and constraints often faced by social agribusinesses in emerging markets. It also provides in-depth insight into direct and indirect factors that affect agribusinesses’ operations. This case will be helpful to individuals interested in agribusiness development and management, social entrepreneurship, supply and value chain development, marketing and communication strategies, and market expansion strategies.

Introduction

In 2005, Dr. Hitimana founded Ikirezi with the intention of addressing poverty in rural areas in Rwanda. Ikirezi defines itself as a community-interest business. It is an organization that “achieves its primary social mission using business methods, through revenue-generating business.”[2] Ikirezi’s vision statement is to be “a leading producer of high-quality essential oils and other natural plant products that maximize profits to small farmers, [and] holistically transforms communities and strengthens agribusiness in Rwanda.”[3]

The business model of Ikirezi incorporates social responsibility at its core and emphasizes hiring vulnerable groups. For instance, eight out of ten of Ikirezi’s farm employees are either widows or adult orphans. Farm employees are trained according to Ikirezi’s agricultural production processes and each employee is independently in charge of single plots of leased, Ikirezi farmland. Ikirezi pays its employees above national average wages and provides ongoing skill-based training and materials such as plant seeds for farmers even after they leave the company to start their own farms.

As the only Rwandan essential oils producer, Ikirezi has faced many struggles and challenges over the years.[4] From the beginning, it was difficult to operationalize farms, train new farmers, break into the essential oils industry, and find buyers. The company, however, persevered and eventually became an established exporter of high-quality essential oils. Today, Ikirezi produces high-quality, one hundred percent pure, and certified organic essential oils.[5]

Even after over ten years of operation, however, Ikirezi is still struggling to generate enough profits and to increase efficiency. As a result, Dr. Hitimana is reconsidering his current business strategy, which is focused on exports to international markets. He recently received a market research study on the domestic Rwandan market for essential oils, which has found that there is potential for new target markets within Rwanda.[6] Important questions for Dr. Hitimana are threefold: first, what is the best business strategy and vision for his company going forward, and second, should Ikirezi continue to focus on the international market or begin looking for new opportunities for growth within Rwanda? In either case, how can Ikirezi increase sales given its limited resources? Dr. Hitimana needs to make careful business decisions for the future of his company, staff, and farmers.

Background: Rwanda

Political Landscape

Rwanda is a landlocked country situated in East Africa. With a population of 11,809,295 and a total area of 26,338 kilometers squared, it is one of the most densely populated countries in Africa. The current political context of Rwanda is largely affected by the civil war of the early 1990s and the genocide that took place in 1994. A transitional government was established following this genocide to introduce vital changes, which opened the doors for reconciliation and rebuilding. With the introduction of a new constitution in 2003, Rwandans elected Paul Kagame as their head of state for two consecutive elections, which took place in 2003 and 2010.[7]

Under Paul Kagame’s leadership, Rwanda has remained politically stable, which has helped the country maintain steady economic growth over the past two decades.[8]

In 2000, President Kagame launched Vision 2020, an ambitious development strategy with the goal of transforming the country into a middle-income nation in which Rwandans would be healthier, better educated, and more prosperous.[9]

As outlined in the Vision 2020 plan, the development policy is based on the following six principal pillars: 1) good governance and increased efficiency in the private sector; 2) skilled human capital bolstered by education, health, and information technology; 3) vibrant private sector; 4) world-class physical infrastructure; 5) modernization of agriculture; and 6) regional integration.[10]

This strategy is implemented through short-term development plans, and the Economic Development and Poverty Reduction Strategy 2013-2018 (EDPRS II) guides the actions that will lead to the achievement of the Vision 2020 goals.

EDPRS II aims to bolster economic development and poverty reduction through the intensification and commercialization of the agriculture sector. One of the main techniques with which the government aims to achieve this objective is the development of private-sector-driven value chains. In this regard, the government supports the greater involvement of the private sector to increase agricultural exports, processing, and value addition. The government offers various incentives such as tax exemption and low-interest loans to support agribusiness in the country.[11] As an agri-business, Ikirezi has the potential to take advantage of these favorable government policies.

Economic and Business Environment

Rwanda has experienced a period of economic prosperity in the past two decades. Real Gross Domestic Product (GDP) grew by an average of eight percent annually during the period 2000 to 2013, which is among the highest average growth rates in East Africa. Strong economic growth has resulted in an increase in per capita income from $240 in 2000 to $700 in 2015, while poverty levels have reduced from 56.7 percent in 2005 to 44.9 percent in 2010, lifting one million Rwandans out of poverty.[12]

In addition to its booming economy, Rwanda is currently experiencing growth in its middle-class due to job creation and the increasing number of women entering the workforce.[13] Experts from the Organization for Economic Co-operation and Development (OECD) believe that members of the middle-class are more willing to spend their disposable income than individuals in other income groups.[14]

Reforms in the business environment have also made it easier for individuals and groups to start businesses, and for businesses to obtain permits and pay taxes. These reforms have boosted Rwanda’s ratings in the World Bank’s “Doing Business Report.”[15] In 2017, Rwanda was ranked fifty-sixth out of 190 countries and received distinction as the second-easiest country in which to do business in Sub-Saharan Africa.[16]

Rwanda’s economy is primarily agrarian, with ninety percent of the population engaged in subsistence agriculture.[17] Under EDPRS II, the government aims for a twenty-eight percent increase in the value of exports by 2020.[18] As a natural plant product with high potential for generating additional exports and increasing farmer income, essential oils were selected as one of the priority products for export diversification.[19] The country’s warm climate enables farmers to harvest multiple times a year.

The increasing global demand for essential oils,[20] combined with Rwanda’s conducive climate for their production, could present unique investment and business opportunities for Ikirezi.

Climate Change

Since crop production relies heavily on rainfall, Ikirezi’s operations depend to a large degree on climate. Typically, Rwanda has two rainy seasons per year, from March to May and from October to December, with a dry season in between. Due to climate change, however, the seasons have become increasingly unpredictable. Dr. Hitimana and the operations manager, Mr. Ntawiheba, have noted that rainfall in Rwanda has been delayed by two months each year for the past three years. According to Dr. Frank Rijsberman, the director of the Global Green Growth Institute, water as a natural resource is becoming increasingly scarce, which is causing the Rwandan agricultural community to increase their use of irrigation techniques to reach their production goals.[21]

Recognizing the risks that climate change poses to the country’s agriculture sector and water sources, the Rwandan government is working to “expand irrigation infrastructure and implement integrated water resource management.”[22] The government believes that farmers can decrease their vulnerability to the changing rainfall patterns by using irrigation infrastructure to gain more control over their water supply. Dr. Hitimana plans to switch from pedal pumps to drip irrigation, which would allow Ikirezi farmers to raise the biomass of their harvests and consequently increase the quantity of product available for sale.

The Company

The founding of Ikirezi Natural Products is deeply connected to the painful history of the Rwandan genocide of 1994. As a result of the genocide, Dr. Nicholas Hitimana left the country with his wife, Elsie, moving first to the Democratic Republic of Congo, then to Kenya, and eventually to the United Kingdom where he earned a doctorate in Rural Development and Applied Entomology at the University of Edinburgh, Scotland. Upon the completion of his Ph.D., Dr. Hitimana and his wife felt a deep calling to help rebuild their country and decided to return to Rwanda with their children.

In 2003, a few years after his return to Rwanda, Dr. Hitimana participated in an agricultural pilot project which examined the feasibility of producing essential oils and other natural plant products in the country. The pilot project revealed that Rwanda had the potential to produce geraniums with an advantage over South Africa.[23] This project led Dr. Hitimana to set a goal of growing geraniums in Rwanda.

In 2005, Dr. Hitimana founded Ikirezi Natural Products as an agribusiness that produces essential oils with a primary and unique focus on poverty alleviation in rural Rwandese communities. He decided against creating a cooperative or a non-government organization (NGO): “After much deliberation, we chose the social business model because it would maximize profits for our farmers as we work to solve social issues. NGOs had inundated the country and had somewhat weakened Rwandan dignity and self-sufficiency. We were keen on helping communities help themselves.”[24] He stated the mission of Ikirezi to be “[producing] high-quality essential oils and other natural plant products in partnership with small-scale farmers.”[25] The goals of Ikirezi are to recognize every individual’s dignity, to holistically impact communities, sustainably transform communities, and strategically collaborate with institutions and individuals to achieve a common vision. Additionally, Dr. Hitimana believes that in order to empower farmers and provide an economic solution to poverty, Ikirezi needs to value grace, humility, and compassion, which are collectively referred to as ‘ubuntu’ in Southern Africa.[26]

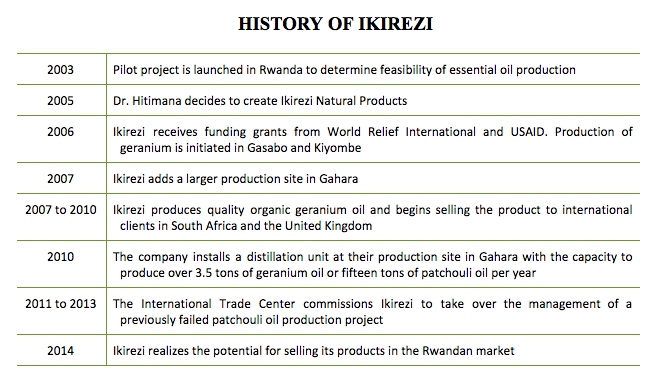

In the beginning, the company had limited capital to become fully operational. But in 2006, Ikirezi received significant funding from World Relief International and United States Agency for International Development (USAID) to begin the production of geraniums. The following year, Ikirezi was able to open a new site at Gahara. The evolution of Ikirezi is detailed in the following figure:

Figure 1: Ikirezi Historical Timeline

Figure 1: Ikirezi Historical Timeline

Business Operations

Supply and Value Chain

Currently, Ikirezi is the only company that produces and exports essential oils in Rwanda.[27] It mainly produces four different types of essential oils– geranium, patchouli, lemongrass, and eucalyptus– as well as small quantities of marigold.

Initially, Ikirezi exported most of their products, with approximately eighty percent of their sales coming from the international market and the remaining twenty percent of the Rwandan market. The global economic crisis of 2008 resulted in a decrease in sales for the company, leaving Ikirezi with over fifty kilograms of unsold stock. As a result of this experience, the company’s management realized that a shift in strategy might be needed to weather future fluctuations in the global market. Specifically, they realized this need because people started to recognize Ikirezi products and approach Dr. Hitimana about why he was not selling the products locally. Because of these conversations, Dr. Hitimana and his staff started wondering if they should target local markets.[28][29]

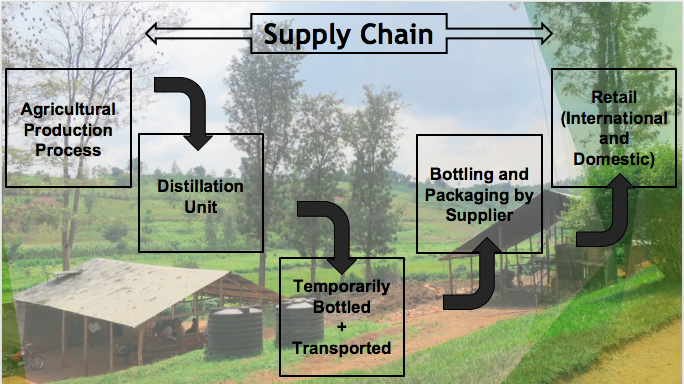

Ikirezi’s value chain is a process, in which value-adding activities begin at the onset of all three of Ikirezi’s production sites. At a single production site, Ikirezi’s “seed to bottle” model begins with seventy to eighty full-time and part-time farmworkers. Eight out of ten farmworkers employed are either widows or adult orphans. Farmers are trained according to Ikirezi’s agricultural production processes and each farmer is independently in charge of a single plot of leased Ikirezi farmland. On the ground, the land is cultivated –that is, hoed and tilled–until it is ready to receive the seedlings. In the case of geraniums, the essential oil process begins with seedlings procured in nurseries that are later transferred to the land.[30] During the crop maintenance process, plants are matured–that is, watered, mulched, weeded–and then harvested when the desired biomass of the plant is reached. To avoid compromising the delicate quality of the plants’ leaves, a select group of farmers is tasked with harvesting (i.e. cutting) the leaves from their root. Leaves are then bundled and transferred by foot to be weighed by farm technicians.[31]

After the leaves are weighted, they are laid on a cement floor outdoors and left to wilt.[32] Wilted leaves are transferred to the distillation unit (see Figure 2) in which a technician oversees that the correct heating and cooling processes occur to condense and extract oil from the leaves. The distillation time varies depending on the type of oil; for example, the distillation of geranium leaves may last five hours. Once the technician has extracted, filtered, and evaluated the oil, it is then transported to Kigali. The oil is hand-bottled, labeled, and prepared for packaging in the main office.

Figure 2: Ikirezi’s Supply Chain (Cornell SMART Market Research Study, 2017)

Each step in this assembly line is unique to Ikirezi’s value chain and allows for continued success in essential oil production.

The essential oil is poured and bottled into small glass vials, which are imported from China. The vials, dark brown in color, are known to preserve the oil’s quality, fragrance, and color. Furthermore, due to the intensive labor processes involved in procuring oils that are ECOCERT certified, 100 percent pure, and organic, the production of one liter of an essential oil can vary between six to seven months. At the same time, one single vial of essential oil has a shelf life of one year after the bottle seal is broken.[33]

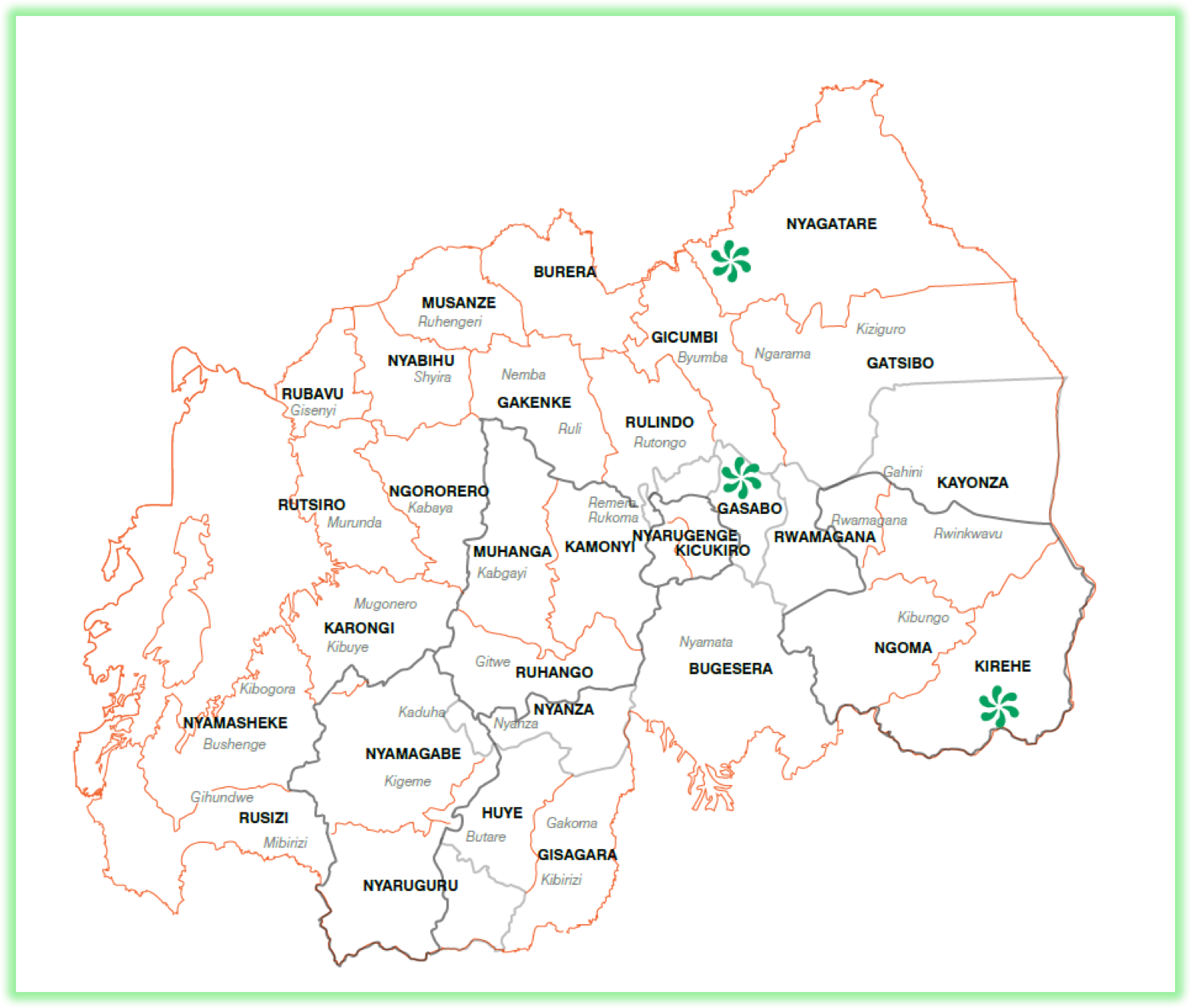

Ikirezi’s production sites, shown in Figure 3, have provided employment opportunities for hundreds of farm employees, most of whom were widowed or orphaned by the genocide. The company has contracted with local communities at production sites to lease communal land for essential oil plant production.

Figure 3: Ikirezi essential oil production sites (Ikirezi Business Plan, 2014)

Figure 3: Ikirezi essential oil production sites (Ikirezi Business Plan, 2014)

Products[34]

Ikirezi’s essential oils can be purchased in small vials and in larger quantities by the liter. Other products for retail include geranium roll-ons, sprays and mists, and clay pots used for diffusing the oils. Domestic orders for Ikirezi products are made to the main office in Kigali via email, in person, or by phone, while international orders in commodity form are made electronically. The product is then packaged and shipped to the customer.

Placement

Since essential oils are a high-end product, their market is very segmented. Most of Ikirezi’s essential oils are exported to be processed further for the production of beauty products. Domestically, Ikirezi works with retail outlets, hotels, gift shops, and spas catering to expatriates and to middle- and upper-class Rwandan communities. These retail outlets typically use these essential oils for massage and aromatherapy purposes. Although the demand for essential oils in Rwanda is rather small, due to their sale as retail products, the company’s profit margins are higher for their retail products than their bulk exportation of oils.

Currently, Ikirezi’s only direct point of sale is its main office in Kigali. The company does not have a designated list of retail outlets for customers, even though there are several hotels and spas that sell its products.

At present, Ikirezi works with four cooperatives at four different sites in Rwanda, employing more than one hundred farmers directly and more during the peak seasons.

In accordance with Ikirezi’s vision to combine sustainable and best business practices with a social purpose, Ikirezi’s shareholders are committed to utilizing net profits in order to (i) provide a dividend to farmers’ associations/cooperatives, (ii) reinvest in strengthening the core business, (iii) expand operations into new products or territory, or (iv) provide infrastructure projects to participating communities. Dr. Hitimana affirmed this commitment in a simple manner, stating: “Farmers do most of the work. Why shouldn’t they get paid the most? They can’t go below thirty percent of the value of the products.”[35]

Additionally, focus groups and an in-depth interview conducted with Ikirezi farmers revealed that farmers have received both tangible and intangible benefits through their employment with Ikirezi. For instance, Vincent Habimana, a farmer who partners with Ikirezi, has built a house and purchased livestock with his savings, which helped him increase his income and establish a side business. Another farmer expressed how she uses the farming skills she learned from training with Ikirezi to tend to her family plantations.

Figure 4: Vincent Habimama, an Ikirezi farmer, and his family. (Cornell SMART Market Research Report, 2017)

Market Research

Methodology

A mixed methods approach was used. Data was collected through surveys, a focus group, and meetings with the Minister of Agriculture and a representative of MTN. The company selected four target cities to survey: Kigali, Gisenyi, Musanze, and Huye.

Sample

A total of seventy-five surveys were conducted (seven surveys with existing clients and sixty-eight surveys with potential clients), along with one focus group discussion. Surveys primarily targeted hotels and spas. A representative from each business was interviewed, usually the general manager.

Survey Design

The survey questionnaire contained both open-ended and closed-ended questions, while the focus group was semi-structured.

Marketing and Communications

Marketing and communication is a crucial factor in business performance. Especially in small and medium enterprises. Various studies have found that limited marketing focus could lead to weak performance (Jones and Rowley, 2011). With this in mind, the company’s present marketing and communications strategies are analyzed within the framework of a marketing mix approach (that is, the way a product or service is presented to the market).

Promotion

Currently, a small percentage of Ikirezi’s essential oil products are sold on the domestic market as value-added products, while the bulk of output is sold to importers in South Africa, the UK, Switzerland, and the U.S. as a commodity. As the international market has been Ikirezi’s primary target, the company’s marketing and branding strategy emphasize the product’s country of origin— Rwanda– and its business model of social enterprise.

According to Ms. Uwubuntu, Ikirezi’s administrator, the company currently promotes its products using face-to-face communication at church events and international and local fairs organized by expatriate communities. The market research study affirmed the importance of Ikirezi’s strategy, which uses social networking as the primary means of promoting its products. The market analysis revealed that word-of-mouth was the main channel through which respondents were familiar with Ikirezi.[36]

In order to reach a wider audience and increase their brand recognition, Ikirezi in 2016, launched a Facebook page to take advantage of growing numbers of social media users. Telecommunication is the company’s main method of communication with its customers.[37]

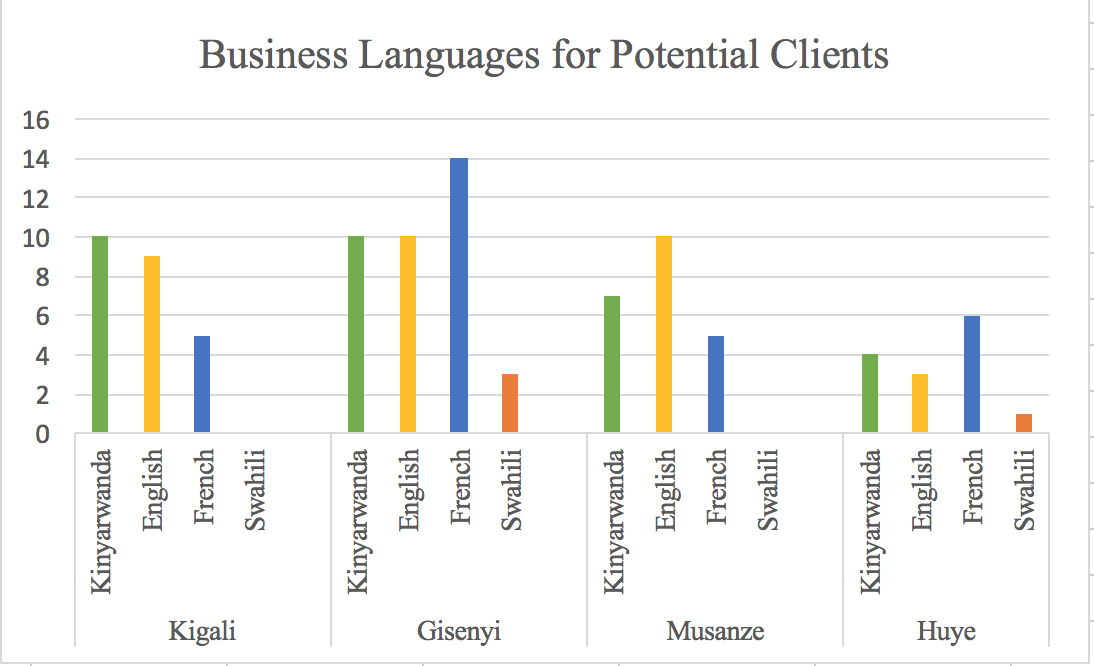

Ikirezi’s website is another means of communication with potential customers. Yet, the website has general information about the company only in English and does not publish details about their products’ prices. With increasing demand for detailed product information, Marcella and Davies note that “language was thought likely to be highly influential” in customer communication.[38] The market research study, as illustrated in Figure 6, found that, in towns closest to the border with the Democratic Republic of the Congo, French was the second most dominant language after Kinyarwanda. Due to the high number of French-speaking visitors, hotels and spas in Gisenyi conducted their business in French, while Huye, the former colonial capital, also has a high number of French-speaking people. By contrast, in the capital city of Kigali and in Musanze–a touristic town– English was the preferred secondary language.

Figure 5: Business Languages for Potential Clients (Cornell SMART Market Research Study, 2017)

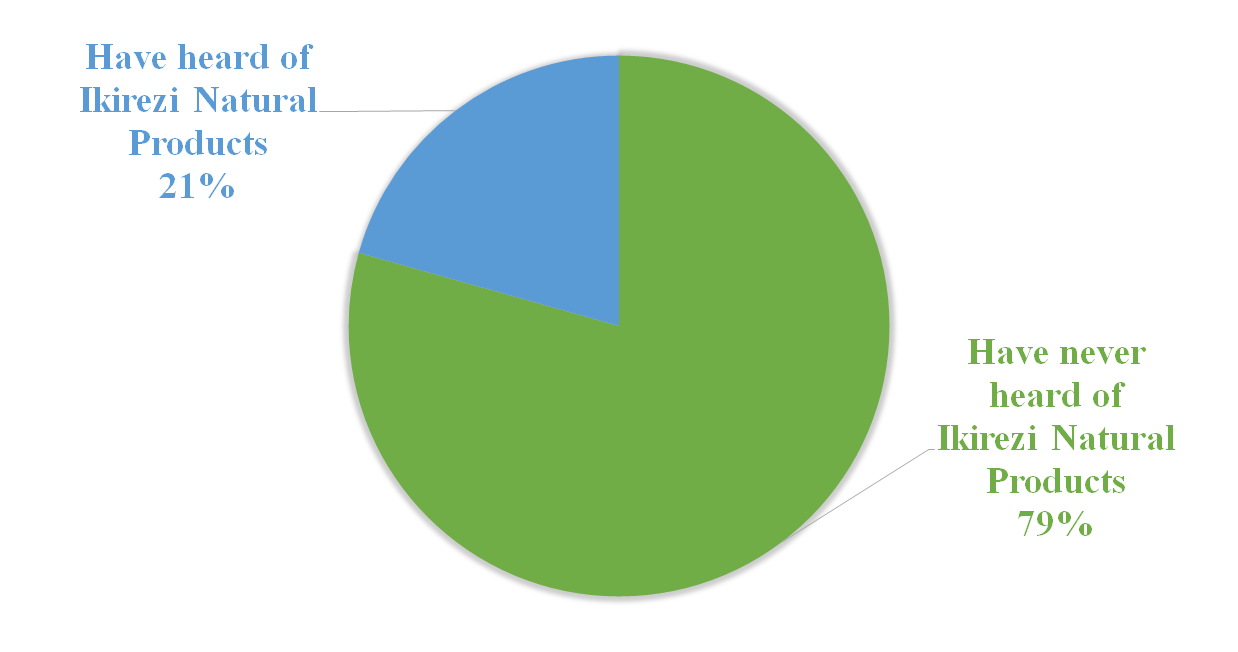

Apart from their social media and online presence, the company does not currently utilize any formal strategy to promote their products. Due to its limited promotional efforts, the brand has very low recognition among its target audience, as seventy-nine percent of hospitality survey respondents had not heard of the brand. (See Figure 6.)

Figure 6: Awareness of Ikirezi (Cornell SMART Market Research Study, 2017)

In this regard, it is crucial for Ikirezi to improve its brand recognition to advance sales both domestically and internationally. In the short-term, social media promotion can serve as one recommended channel through which Ikirezi can increase brand recognition, while long-term measures could involve more costly means such as radio and television promotion that are scaled across local and regional media outlets.

Potential Challenges

While Ikirezi produces high-quality essential oils, it faces the challenge of brand recognition in Rwanda as essential oils and their benefits are unfamiliar to Rwandans. “Because many people in Rwanda don’t know about essential oils, we have to spend time and energy teaching people how to use the oils at market fairs, etc. However, doing so is costly and unpredictable because you can’t predict how many people will buy the products.” [39]

Additionally, Ikirezi’s earnings have not allowed the company to invest in domestic commercial advertising. Ikirezi’s experience has shown that marketing techniques that focus on educating the potential client about Ikirezi’s products and their uses are necessary for creating new customers, but such strategies can be risky given their costs and unexpected returns.

Survey results revealed that Rwandans newly introduced to essential oils find Ikirezi products too expensive given their small sizes.[40]

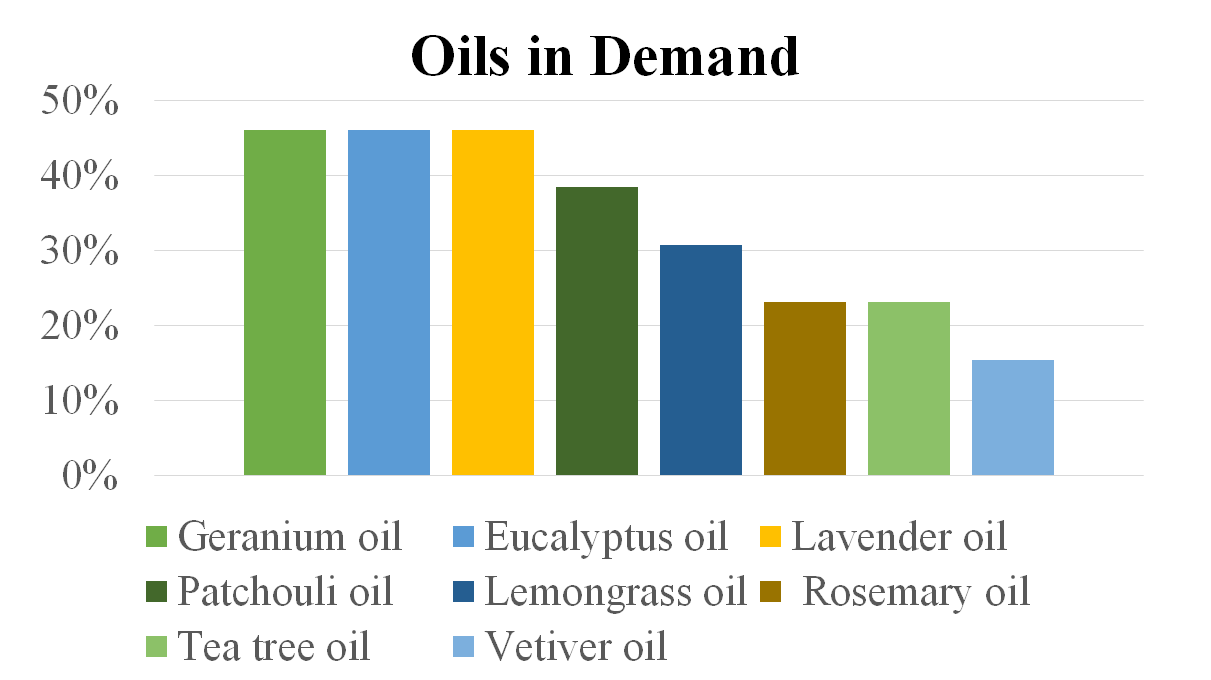

Although Ikirezi has the advantage of being the only Rwandan producer of essential oils, it faces competition from other producers of essential oils, primarily from South Africa. Ikirezi produces four types of essential oils. Lavender, though in high demand in Rwanda, is not widely harvested because the country’s climate is not ideal for lavender cultivation. However, Ikirezi has invested in research and development to meet the domestic demands for essential oils (see Figure 7). Ikirezi is currently undertaking research to find whether plants that produce other types of essential oils, such as lavender, tea tree, and rosemary, can be grown successfully in Rwanda.

Figure 7: In-Demand Essential Oils (Cornell SMART Market Research Study, 2017)

In Rwanda, social enterprises are not yet differentiated from private businesses in terms of policies, taxation, and incentives.[41] Therefore, Ikirezi depends on the quality of its products, and the stories of its communities to build a strong brand within Rwanda. Despite its strengths, Ikirezi faces intense competition from Rwanda’s largest competitor in the essential oil industry, South Africa. Fortunately, the Rwandan government’s recent “Made-in-Rwanda” campaign that promotes the production and consumption of Rwandan goods may help the organization in ways that could accelerate brand recognition and increase sales (Domestic Market Recapturing Strategy, 2015). Ikirezi is currently looking to find additional sources of funding to support future growth and research and development.

Human Resources

Over the years, the responsibilities of each Ikirezi employee have increased, and staff members often feel overstretched.[42] For example, the employee responsible for marketing also handles the bottling of the essential oils, manages order placement and delivery, and supervises the intern’s work. Additionally, she is often asked to attend visitors to the main office. Ikirezi’s limited in-house staff hinders its ability to recruit, hire, and train more employees which impedes the company’s ability to meet customer service demands satisfactorily.

Potential Opportunities

Rwanda’s Emerging Middle-Class

Rwanda’s middle-classes look to spend their income on both local and international products.[43] Because of their willingness to spend, the group has the potential to define the demand base for products on the market.[44] As it continues to expand, Rwanda’s middle-class is experiencing “changes in lifestyle, more recreational time, and greater spending power” which is causing individuals to purchase items that were typically marketed to members of the upper-class and tourists, including Ikirezi’s products.

Over the past two decades, there has been a substantial increase in the market size of essential oils. This increase has been attributed to growing demand in the food and lifestyle industries.[45] Consumers all over the world are increasingly educated about healthy lifestyles, and there are increasing applications of essential oils in aromatherapy.[46] The increase in domestic and global consumer awareness about essential oils, coupled with a simultaneous growth of the Rwandan tourism industry, presents a unique opportunity for Ikirezi. According to the Rwanda Development Board, the number of tourist arrivals in Rwanda has more than doubled since 2010, which contributes to incremental increases in the nation’s revenue.[47] The Ikirezi staff have stated this increase in tourism as a potential opportunity for domestic growth.

Ikirezi currently has partnerships with hotels to market its products to tourists. As the only “Made in Rwanda,” organic-certified essential oil company, Ikirezi represents a differentiated brand that is easily marketable to tourists.

Conclusion

It is Dr. Hitimana’s dream to witness Ikirezi grow in the coming years, as exporting costs remain relatively low and untapped markets for essential oils in the West, Central, and East African regions are forthcoming.[48] However, competition looms in the European, Asian, and South African essential oil markets, while domestic competition is virtually non-existent. Further, the microeconomic environment in Rwanda is a boon for small and medium-sized enterprises that seek to expand. Similarly, the Rwandan essential oils industry–albeit in its infancy–is positioned in Ikirezi’s favor.

After multiple readings of the market research study, Dr. Hitimana is aware of the opportunities and challenges that lie ahead. Should Ikirezi explore domestic markets? Is it possible to market the brand in Rwanda successfully amidst limited resources? Aware that strategic decisions need to be made in the coming year, Dr. Hitimana is also considering the potential consequences of the same. With his responsibility for local farmers weighing heavily on his mind, he asks: how can Ikirezi grow in line with the rapid and promising future of Rwanda?

This research was made possible through the support of the Student Multidisciplinary Applied Research Team (SMART) program within the Emerging Markets Program (EMP) in the Charles H. Dyson School of Applied Economics and Management at Cornell University. Many thanks to Dr. Nicholas Hitimana (CEO of Ikirezi), his staff and partners, and other stakeholders who hosted and supported the SMART students in Rwanda.

References

- “Vision & Mission.” Ikirezi Natural Products. Accessed May 05, 2018. https://www.ikirezi.com/missionandvision/. ↑

- Katz, Robert A., and Antony Page. “The Role of Social Enterprise.” SSRN Scholarly Paper. Rochester, NY: Social Science Research Network, December 13, 2010. https://papers.ssrn.com/abstract=1724942. ↑

- “Vision & Mission.” Ikirezi Natural Products. Accessed May 05, 2018. https://www.ikirezi.com/missionandvision/. ↑

- “Essential Oils.” National Agricultural Export Development Board. Accessed May 5, 2018. http://naeb.gov.rw/index.php?id=145. ↑

- “Products Overview.” Ikirezi Natural Products. Accessed May 5, 2018.https://www.ikirezi.com/productsoverview/. ↑

- In January 2017, a Student Multidisciplinary Applied Research Team (SMART) of five students from Cornell University, working in partnership with the Ikirezi team, conducted two-week long market research for essential oils in Rwanda. See Annex A. ↑

- “About Rwanda.” UNDP Rwanda. Accessed May 5, 2018. http://www.rw.undp.org/content/rwanda/en/home/countryinfo/. ↑

- “Doing Business 2018: Rwanda.” World Bank Group, 2018. http://www.doingbusiness.org/~/media/wbg/doingbusiness/documents/profiles/country/rwa.pdf. ↑

- “Rwanda Vision 2020.” Kigali, Rwanda: Ministry of Finance and Economic Planning, 2000. https://www.sida.se/globalassets/global/countries-and-regions/africa/rwanda/d402331a.pdf. ↑

- “Rwanda Vision 2020.” Kigali, Rwanda: Ministry of Finance and Economic Planning, 2000. https://www.sida.se/globalassets/global/countries-and-regions/africa/rwanda/d402331a.pdf. ↑

- “Economic Development and Poverty Reduction Strategy II: 2013 – 2018.” Ministry of Finance and Economic Planning, May 2013. http://www.minecofin.gov.rw/fileadmin/templates/documents/NDPR/EDPRS_2.pdf. ↑

- “Doing Business 2018: Rwanda.” World Bank Group, 2018. http://www.doingbusiness.org/~/media/wbg/doingbusiness/documents/profiles/country/rwa.pdf. ↑

- “Rwanda: Middle-Class Growing in High Speed Says UNDP Report.” Great Lakes Voice, March 18, 2013. http://greatlakesvoice.com/rwandamiddle-class-growing-in-high-speed-says-undp-report/. ↑

- Junior Mutabazi, “A Growing Middle-class Will Attract More Investments,” The New Times | Rwanda, last modified September 7, 2016, http://www.newtimes.co.rw/section/article/2016-09-08/203336/. ↑

- “Doing Business 2018: Rwanda.” World Bank Group, 2018. http://www.doingbusiness.org/~/media/wbg/doingbusiness/documents/profiles/country/rwa.pdf. ↑

- “Doing Business 2018: Rwanda.” World Bank Group, 2018. http://www.doingbusiness.org/~/media/wbg/doingbusiness/documents/profiles/country/rwa.pdf. ↑

- “Africa: Rwanda.” The World Factbook, May 1, 2018. https://www.cia.gov/library/publications/the-world-factbook/geos/rw.html. ↑

- “Economic Development and Poverty Reduction Strategy II: 2013 – 2018.” Ministry of Finance and Economic Planning, May 2013. http://www.minecofin.gov.rw/fileadmin/templates/documents/NDPR/EDPRS_2.pdf. ↑

- “Essential Oils.” National Agricultural Export Development Board. Accessed May 5, 2018. http://naeb.gov.rw/index.php?id=145. ↑

- The Rwanda Development Board (2017) estimates that the global market demand for geranium and patchouli will continue to increase five percent annually. ↑

- Rijsberman, Frank R. “Water Scarcity: Fact or Fiction?” Agricultural Water Management, Special Issue on Water Scarcity: Challenges and Opportunities for Crop Science, 80, no. 1 (February 24, 2006): 5–22. https://doi.org/10.1016/j.agwat.2005.07.001. ↑

- “Green Growth and Climate Resilience: National Strategy for Climate Change and Low Carbon Development.” Kigali, Rwanda: The Rwanda National Strategy on Climate Change and Low Carbon Development, November 2011. http://rema.gov.rw/climateportal/IMG/pdf/green-growth-strategy-final.pdf. ↑

- Nicholas Hitimana, Personal Interview. Rwanda, January 9, 2017. ↑

- Hitimana ↑

- Hitimana ↑

- Hitimana ↑

- “Essential Oils.” National Agricultural Export Development Board. Accessed May 5, 2018. http://naeb.gov.rw/index.php?id=145. ↑

- Nicholas Hitimana, Personal Interview. Rwanda, January 9, 2017. ↑

- Michelle Uwubuntu, Personal Interview. Rwanda, January 18, 2017. ↑

- In addition to geraniums, lemongrass and patchouli plants are raised in nurseries. ↑

- Altangerel, “From the Farm to the Spa.” ↑

- Wilting: (of a plant, leaf, or flower) become limp through heat, loss of water, or disease; droop. “Wilt.” Merriam-Webster.com. Accessed March 21, 2017. https://www.merriam-webster.com/dictionary/wilt. ↑

- Michelle Uwubuntu, Personal Interview. Rwanda, January 18, 2017. ↑

- For detailed product description, see Annex B. ↑

- Nicholas Hitimana, Personal Interview. Rwanda, January 9, 2017. ↑

- Altangerel, “From the Farm to the Spa.” ↑

- Altangerel, “From the Farm to the Spa.” ↑

- Rita Marcella and Sylvie Davies, “The use of customer language in international marketing communication in the Scottish food and drink industry,” European Journal of Marketing 38, no. 11/12 (2004): doi: 10.1108/03090560410560155. ↑

- Michelle Uwubuntu, Personal Interview. Rwanda, January 18, 2017. ↑

- Altangerel, “From the Farm to the Spa.” ↑

- Nicholas Hitimana, Personal Interview. Rwanda, January 9, 2017. ↑

- Michelle Uwubuntu, Personal Interview. Rwanda, January 18, 2017. ↑

- Mutabazi, “A Growing Middle-class” ↑

- Mutabazi, “A Growing Middle-class” ↑

- “Ikirezi Investment Brief,” Official Rwanda Development Board (RDB) Website, accessed December 25, 2016, http://www.rdb.rw/fileadmin/user_upload/Documents/Agriculture/T%20arround%20companies/Ikirezi_InvestmentBrief.pdf. ↑

- Essential Oil Market Analysis By Product (Orange, Corn Mint, Eucalyptus, Citronella, Peppermint, Lemon, Clove Leaf, Lime, Spearmint), By Application (Medical, Food & Beverage, Spa & Relaxation, Cleaning & Home) And Segment Forecasts To Market. Grand View Research (2016). Assessed March 12, 2017. ↑

- “Ikirezi Investment Brief,” Official Rwanda Development Board (RDB). ↑

- Altangerel, “From the Farm to the Spa.” ↑